The contribution margin represents the revenue required to cover a business’ fixed costs and contribute to its profit. With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit. Break-even analysis assumes that the fixed and variable costs remain constant over time. However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

Why You Can Trust Finance Strategists

The break-even point (BEP) is the point at which the costs of running your business equals the amount of revenue generated by your business in a specified period of time. In other words, your company is neither making money nor losing it. Our break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. Once you calculate your break-even point, you can determine how many products you need to manufacture and sell to make your business profitable. He is considering introducing a new soft drink, called Sam’s Silly Soda.

How do fixed expenses impact the break-even point of a grocery store?

- Thus, if a project costs $1 million to undertake, it would need to generate $1 million in net profits before it breaks even.

- Or, a potential third option, which is to examine how to reduce fixed costs.

- By using the formula to calculate your break-even revenue, you can make informed decisions about pricing, cost-cutting measures, and sales targets.

- Fortunately, you can answer this question by calculating your break-even point.

- If the price stays right at $110, they are at the BEP because they are not making or losing anything.

From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price. At that breakeven price, payroll the homeowner would exactly break even, neither making nor losing any money. Balancing pricing with perceived value and market demand is key to optimizing profitability.

How can the break-even point help your business?

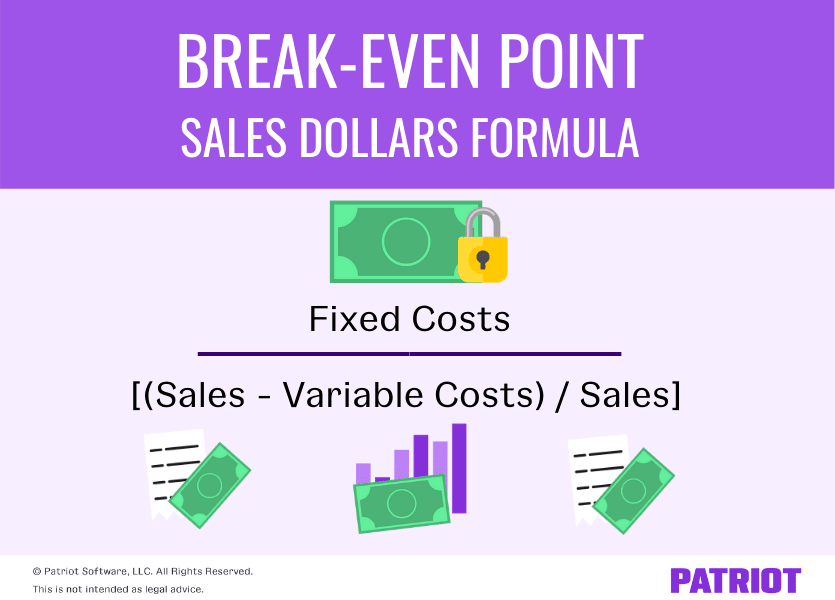

The break-even formula in sales dollars is calculated by multiplying the price of each unit by the answer from our first equation. Fixed Costs – Fixed costs are ones that typically do not change, or change only slightly. Examples of fixed costs for a business are monthly utility expenses and rent. The break-even point allows a company to know when it, or one of its products, will start to be profitable.

The breakeven point doesn’t typically factor in commission costs, although these fees could be included if desired. Finally, the breakeven analysis often ignores qualitative factors such as market competition, customer satisfaction, and product quality. While the breakeven point focuses on financial metrics, successful business decisions also require a holistic view that looks outside the number. For example, it may just not be feasible to sell 10,000 units given the current market for the example above. A well-planned pricing strategy can influence sales volume and gross margin, impacting the break-even point. A prime location may have higher fixed costs but can lead to increased sales, potentially lowering the break-even point.

What is a Break-Even Point and How to Calculate

Investing in technology, such as point-of-sale systems and inventory management software, can streamline operations and reduce costs. Economies of scale can reduce the cost per unit, lowering the break-even point as the store grows. A grocery store with efficient inventory management can achieve a turnover rate of 10 to 15 times per year. These are questions we frequently receive from entrepreneurs who have downloaded the business plan for a grocery store.

If a business’s revenue is below the break-even point, then the company is operating at a loss. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag.

No matter whether you are a business owner, accountant, entrepreneur or even a marketing specialist – you will often come across this metric, which is why our online calculator is so handy. Stay updated on the latest products and services anytime anywhere. At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. While gathering the information you need to calculate your break-even point is tricky and time consuming, you don’t have to crunch the numbers with just a pen and paper. Any number of free online break-even point calculators can help, like this calculator by the National Association for the Self-Employed.

The company’s owner wants to know how many rackets it has to sell to break even. Toby’s company sells a tennis racket for $100, and the cost of materials and labor for each racket is $60. Plugging these numbers into the contribution margin formula, we get $40 per unit as the contribution margin. Kramer’s Consulting does an audit of its fixed costs and realizes its executive salaries are higher than average for the industry. The CEO, Kramer, decides to reduce his own salary, at least until the company can sustainably increase its revenue.