At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. This can result in abnormal losses as well and unexpected expenses being incurred. GoCardless is a global payments solution that helps you automate payment collection, cutting down on the amount of financial admin your team needs to deal with.

Predetermined Overhead Rate Formula

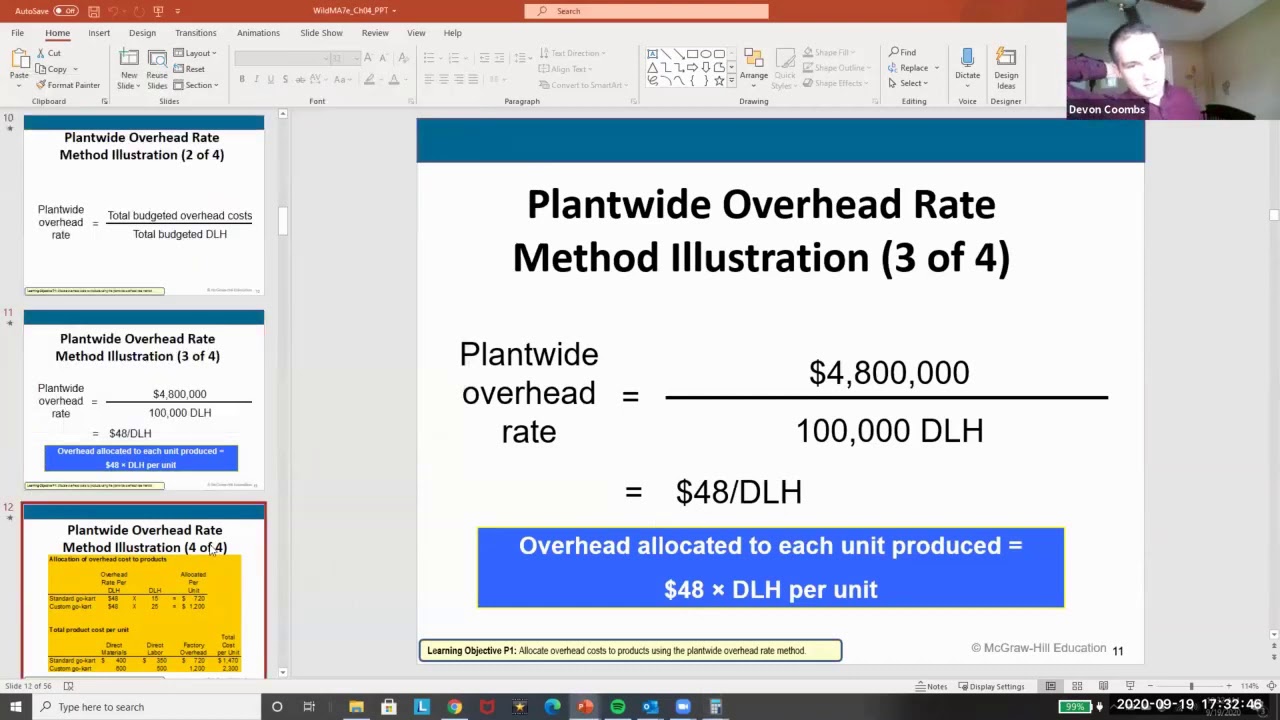

You can calculate this rate by dividing the estimated manufacturing overhead costs for the period by the estimated number of units within the allocation base. The price a business charges its customers is usually negotiated or decided based on the cost of manufacturing. This means that once a business understands the overhead costs per labor hour or product, it can then set accurate pricing that allows it to make a profit.

Ask Any Financial Question

Both figures are estimated and need to be estimated at the start of the project/period. If the business used the traditional costing/absorption costing system, the total overheads amounting to $26,000 will be absorbed using labor hours. This rate would then charge $4 of overhead to production for every direct labor hour worked. It allows overhead to be assigned to production based on activity (DLHs), providing insight into profitability across products. Direct costs are expenses traced to specific products like raw materials or direct labor. This means that for every dollar of direct labor costs, the business will incur $0.20 in overhead costs.

Analyzing Departmental Overhead Rates

If the predetermined overhead rate calculated is nowhere close to being accurate, the decisions based on this rate will definitely be inaccurate, too. That is, if the predetermined overhead rate turns out to be inaccurate and the sales and production decisions are made based on this rate, then the decisions will be faulty. When there is a big difference between the actual and estimated overheads, unexpected expenses will definitely be incurred. Also, profits will be affected when sales and production decisions are based on an inaccurate overhead rate. Suppose the estimated manufacturing overhead cost is $ 250,000 and the estimated labor hours is 2040. A predetermined overhead rate is an estimated amount of overhead costs that will be incurred during a set period of time.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

Financial Forecasting

Hire a professional to help you calculate your predetermined overhead rate. This option is best if you’re unsure of how to calculate your predetermined overhead rate or if you don’t have the time to do it yourself. This option is best if you’re just starting out and don’t have any historical data to work with. This how to calculate predetermined overhead rate predetermined overhead rate can also be used to help the marketing agency estimate its margin on a project. This predetermined overhead rate can be used to help the marketing agency price its services. This means that for every hour of work the marketing agency performs, it will incur $20 in overhead costs.

- As a result, the overhead costs that will be incurred in the actual production process will differ from this estimate.

- If the actual overhead at the end of the accounting period is 1,575 the overhead is said to be under applied by 75 (1,500 – 1,575) as shown in the table below.

- The formula for a predetermined overhead rate is expressed as a ratio of the estimated amount of manufacturing overhead to be incurred in a period to the estimated activity base for the period.

- It’s a good way to close your books quickly, since you don’t have to compile actual manufacturing overhead costs when you get to the end of the period.

- Now that all parts of the equation are determined let’s calculate the predetermined overhead rate.

- The predetermined overhead rate is crucial for accurate cost accounting and efficient management of production costs.

This means that since the project would involve more overheads, the company with the lower overhead rate shall be awarded the auction winner. Hence, you can apply this predetermined overhead rate of 66.47 to the pricing of the new product X. It’s a completely estimated amount that changes with the change in the level of activity. Carefully minimizing overhead is crucial for small businesses to maintain profitability. Following expense optimization best practices and leveraging technology keeps overhead costs in check. Allocating overhead this way provides better visibility into how much overhead each department truly consumes.

The predetermined overhead rate is, therefore, usually used for contract bidding, product pricing, and allocation of resources within a company, based on each department’s utilization of resources. Using activity based costing, it is possible to understand the value of an activity and cost it accordingly instead of using time as a basis for allocating overheads. This rate is useful from the point of view of cost control as it enables management to plan ahead and budget for the future.

The downside is that it increases the amount of accounting labor and is therefore more expensive. One of the advantages of predetermined overhead rate is that businesses can use it to help with closing their books more quickly. This is because using this rate allows them to avoid compiling actual overhead costs as part of their closing process. Nonetheless, it is still essential for businesses to reconcile the difference between the actual overhead and the estimated overhead at the end of their fiscal year. The predetermined overhead rate is based on the anticipated amount of overhead and the anticipated quantum or value of the base. It is worked out by dividing the estimated amount of overhead by the estimated value of the base before actual production commences.

Знайдіть улюблені ігри та насолоджуйтесь грою на vavada.